When you go ahead with the process of opening a Solo 401(k), you should proceed with the right steps.

The foremost step is to choose the right provider of Solo 401(k) that has a significant role to play. It will help you with investment options and also administer your plan. Also, the provider will help you with the entire process of setting up your Solo 401(k).

Factors to Consider

When you look at a prospective Solo 401(k) provider, make sure you consider reputable, and low-cost companies that can meet your specific needs.

It will help if you keep in mind that the Solo 401(k) requirements are different from those of a Traditional 401(k).

Therefore, you will need a provider that has a strong reputation for administering Solo 401(k)s, and also, you should be able to afford the fees.

Specifically, you should consider three factors:

Cost-effectiveness

Make sure you choose a provider with the lowest fees and unnecessarily high fees that might negatively impact your account over the long term.

Good reputation

There are many varieties of providers in terms of size. Some are big, and others are small. It will help if you do not go by the size but by the reputation with an impressive track record.

Adequate Investment Flexibility

As you can have various investment strategies and goals, so make sure to choose a provider with the flexibility to give you access to your investment options.

Once you have finalized a provider and adopted the plan agreement for your new Solo 401(k), you can proceed to open the account with the provider. You can open the account any time before your tax-filing deadline and under the guidelines in your plan documents.

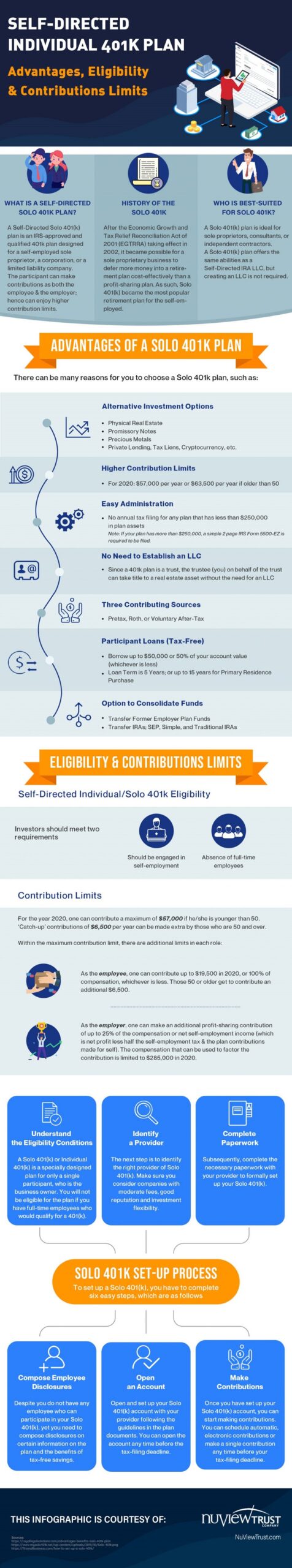

There are many aspects of a Solo 401(k) that you should know. And the infographic in this post serves as a valuable guide.

Comments